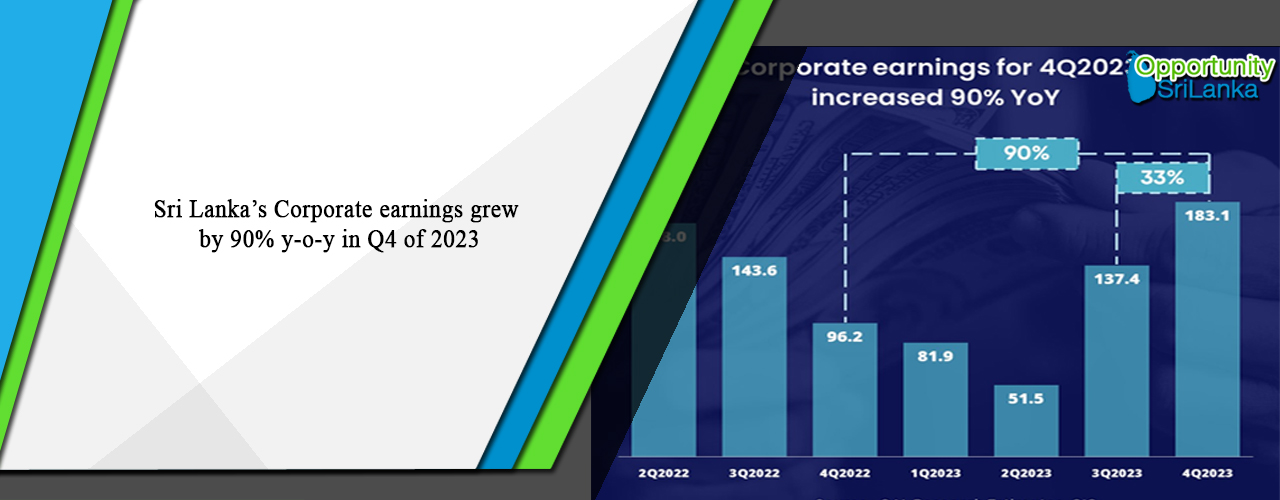

Sri Lanka’s Corporate earnings grew by 90% y-o-y in Q4 of 2023

The Morning: Corporate earnings of Sri Lanka’s listed companies have grown by 90% year-on-year (y-o-y) in the fourth quarter (Q4) of 2023 after the public companies saw a rebound in the second half of the year with declining interest rates reducing finance costs, Capital Alliance Limited (CAL) said.

Accordingly, the fourth quarter of 2023 saw a robust corporate earnings performance, with a remarkable 90% y-o-y growth which was driven by strong performance in the financial services and the food, beverage, and tobacco sectors.

Additionally, the market benefited from a 41% y-o-y reduction in net finance costs, coinciding with declining interest rates and contributing to improved profitability. The net finance cost which stood at Rs. 79.7 billion in Q4 of 2022 with an Average Weighted Prime Lending Rate (AWPLR) of 28.2% has reduced to Rs. 47.1 billion with an AWPLR of 13.2%. Net finance cost peaked in the first quarter of 2023 at Rs. 91.4 billion.

During the first half of the year corporate earnings, the overall corporate earnings stood at Rs. 133.4 billion while in the second half of the year, it recovered to Rs. 320.5 billion. Between the Q3 and Q4 corporate earnings grew by 33% to Rs. 183.1 billion.

However, the revenue declined in Q4 by 2.8% y-o-y to Rs. 1,504 billion amidst a 5.6% decline in industrial segment revenue.

CAL stated that earnings have been mostly driven by higher profitability from financial services and food, beverage and tobacco which accounted to be about 53% of the overall earnings in Q4 of 2023, while capital goods accounted for 16.6% and banks for 13%.

Top earning gainers in the market in Q4 were LOLC with net earnings of Rs. 29.4 billion and Brown Investments PLC with Rs. 22.1 billion. Expolanka was the top loser for the quarter with a net loss of Rs. 5.2 billion.

OSL take:

The increase in Sri Lanka’s corporate earnings year on year is indicative of the strength and growth of the country’s private sector as well as the strength and resilience of the overall economy. Sri Lanka’s economy and the private sector has faced challenging economic conditions in the past few years. Yet, many private sector businesses managed to record profits despite the challenging conditions. However, many local businesses are now engaged in the expansion of operations into foreign countries while recording profits. Given the resilient economy, business conducive environment presented by the country and the strong trade ties with other countries, foreign businesses/investors could confidently explore the growing opportunities in Sri Lanka. Foreign businesses could also look at forming collaborations with local businesses in order to further expand operations. Sri Lanka would definitely be the ideal business destination for foreign businesses/investors looking at doing business in the South Asian region.

| Article Code : | VBS/AT/20240325/Z_2 |